There have been a lot of questions & guessing on what the future holds with respect to inflation and whether the Fed will continue to tighten. I feel it is necessary to put my two cents in and cover it by an angle that nobody else has seen. My opinion is that inflation is here and will be with us going forward. We have been blessed to have a 20+ years of low inflation brought on by Ronald Reagan's reforms and Fed Reserve Volcker's monetary tactics. Their successors have more or less followed the same path that those two had set forth. The fiscal path of less taxation & government and pro business & globalization of George H. W. Bush, Bill Clinton, & George W. Bush. Also the monetary path that Greenspan and now Bernanke have followed is an aggressive and occasionally activist Fed chairmanship that fought inflation hard. So why are we not in perfect harmony with a philosophy that has had such great success? One would think there would be no need to worry about inflation because we know how to fight it. Well like our bacteria friends that can stay contained for some time, all it takes is an opening. And they, like inflation, expose the host's weakness at a torrentual pace. A trifecta of events has converged to create a gaping "hole" for inflation to come through. These three factors are a maturing globalized economy, Bush's fiscal policy, and Greenspan's monetary policy.

During Reagan's time the framework of a globalized economy came to America. Japan was putting pressure on the US economy with cheaper better built goods and technology. Taiwan and parts of east Asia were major manufacturing hotbeds. The US economy adapted and the economies were working together where made in USA was no longer as essential. George H. W. Bush pushed for NAFTA and Clinton followed through with it. Clinton also "opened" up China to the west and into a major trading partner and manufacturer. The technology & information revolution brought the world closer together and allowed for aggressive competition. Businesses were able to utilize technology into coordinating raw materials, parts, manufacturing, shipping, wholesale, and retail into effective supply chains that were a part of global landscape. Prices during the 1980's-present were being pushed down by technology and finding cheaper labor. From Japan, Taiwan, East Asia, parts of Latin America, South Korea, Eastern Europe, China, and India capital would find the cheapest labor. However with these emerging market economies GDP growing by leaps and bounds wage pressures have followed suit. Has the developed world lost its sources of cheap labor? In the short term yes. You look around the globe and parts of Latin America, the underdeveloped and unstable world of Africa, and the politically backward and anti-growth Middle East economies have a long ways to go before they can be fully integrated as a partner (not just an exporter) in the global economy. Suddenly a factor of keeping inflation low is no longer in the equation.

George W. Bush's major tax cuts have been a major and effective economic stimulus that has helped rescue a free falling economy. However the cuts were not followed by any real cuts to government programs and spending. So in a sense a flood of money entered the economy financed by the treasury department and foreign treasury holders. The administration has caused the twin deficits to form which has been at the heart of the trouble the value of the dollar has been having since the turn of the century. I am always in favor of putting more money in individuals hands then the inefficient and bureaucratic government, but there needs to be cuts too. This major influx of cash was efficiently put into the consumer wallet and began the multiplier effect. By itself the policy is solid, but with the other two major factors it creates a perfect storm.

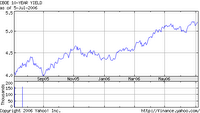

Alan Greenspan in 2001 saw a weakening economy pumped up by a giant peace dividend and a stock market bubble. He began his quest of lowering the federal funds rates from their high of 6.50% and living up to his "Greenspan Put" he pushed them lower and lower. With the weakened economy, the upheaval of September 11th occurred and Greenspan began throwing everything including the kitchen sink at the economy. In one year the rate had gone from 6% to 1.75%, by mid 2003 the federal funds rate was at 1.00%! Many other central banks around the world followed suit by cutting their rates. Not until June 2004 did Greenspan start a gradual rate increases that we have been on for the last 2 years. With the Federal Funds rate at 5% rates are closer to their normal habitat, but the fact is the US and the world had years with a major influx of liquidity. Not only did it cause a glut of liquidity, a red hot housing market spurred on by low rates flooded the economy with even more money. It easy to Monday morning quarterback Greenspan's decisions now; he made these decisions in trying times. The fact remains that it would appear that he left rates too low for too long causing inflation to have a place to roost. The scary part is compared to other central banks the US early on had been more aggressive in raising rates and tightening then most of the world. With our integrated world this leads to more and more liquidity.

Going forward from this analysis it is easy to get depressed or mad at the three factors, but on an individual basis they are good practices for the economy. The fact remains that there is too much money chasing too few goods. This is seen with the increases of prices of hard assets like commodities, real estate, etc. Do I expect inflation to return to 1970's level probably not, but do I expect it to remain low like the past 20+ years, doubt it. In the short term I expect inflation to hover around 5%, where it goes from there is really up to Ben Bernanke. Does he care about keeping inflation in check or will he try to please the economy and stop raising rates. The first would most likely cause a real recession and the later would cause a stagflation scenario after awhile. I would prefer Bernanke becoming an inflation hawk regardless of the consequences. My worry is if he uses the technique of breaking the back of inflation and it has little effect because of the world liquidity glut and leaves the US economy in the gutter and a inflation still running a muck. I, like many others, do not envy his position and the pitfalls at every decision Bernanke makes in the near term. As your investment mercenary I feel it is important for my readers to be cognizant of the consequences of Bernanke's decisions and what led up to them. I think most pundits either don't think inflation is an issue or understand one or two of the reasons for its cause in 2006. Again a maturing globalized economy + Bush's tax cuts + Greenspan's monetary policy has led to a real and present danger of inflation that must be dealt with at any costs.