There has been a lot of talk of the housing market bubble and when it will pop, etc. I do not have a crystal ball, but I will say this, the market in the next 2-3yrs in for a major correction. Unlike the liquidity of the stock market the housing market is slow to move and we will not see the repercussions until really 2007. We are seeing the beginnings with a massive increase in inventory. I have put together some numbers over the last year to show how the interest rates are going to contribute to this correction.

Last year at this time:

- Fed rate was at 3.25%

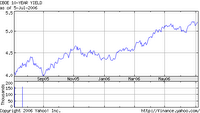

- ten year treasury bond was at 4%

- prime was at 6.25% (Adjustable Rate Mortgage based on)

- 30 year mortgage fixed rate was at 5.5%

Now today these numbers have changed drastically:

- Fed rate at 5.25%

- ten year treasury bond at 5.25%

- prime at 8.25%

- 30 year fixed rates at 7% (APR)

So what do these numbers mean to you? Unless you're a finance nerd like me, then this means absolutely nothing. So let's put it in terms we all can understand: How much is this going to cost me?

Last year if you were looking to buy a $500,000 home with 20% down:

- $400,000 loan amount

- 5.5% 30yr fixed

- $2,271/mo

Now another way of looking at that number is what with today's rates of 7% would the payment of $2,271/mo get you house wise?

- A $341,348 mortgage or

- $426,685 house instead of a $500,000 house

- That's a 15% decline in purchasing power!!!

Has your job given you a raise 15% in the last year? For most American wages have been stagnate over the last 5 years. If you have an ARM loan depending on several factors you're going to have 16-20% decline purchasing power. Let's see what happens if you go 100% financing:

- $400,000 5.5% fixed loan

- $100,000 6.25% Interest Only Equity Line

- $2792/mo

With today's rates lets see what $2,792/mo gets you?

- $341,348 1st mortgage

- $75,758 2nd

- $417,106 house instead of a $500,000 house

- That's a 17% decline in purchasing power!!!

The market has yet to price this in to the real estate market, but when it does you can expect a minimum 20% decline over the next year or two. These numbers a just based on the increase of rates, they don't even take into consideration the froth of the market and the unusual appreciation over the last 5-7 years. The numbers don't lie.

No comments:

Post a Comment